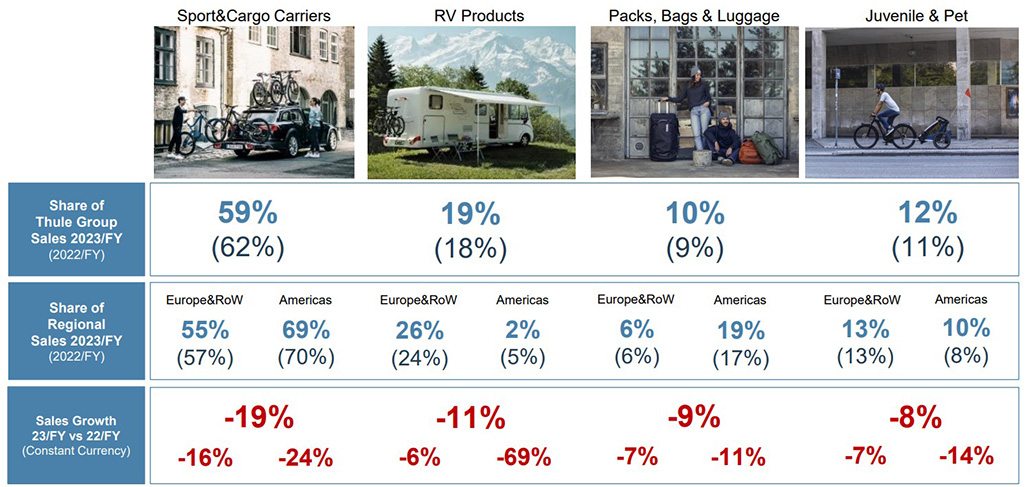

Four product categories

Thule Group is active in four product categories:

Sport&Cargo Carriers

Roof racks, rooftop cargo carriers, rooftop carriers for transporting bike, water and winter sports equipment and, since 2019, rooftop tents.

Share of Group sales in 2022:

62%

Market position:

Clear global market leader as the only company with a truly global position.

Long-term ambition:

Sustained stable growth by further strengthening our market-leading position.

Performance in 2022:

Sales declined 17 percent in local currency after an exceptionally strong 2021. Annual average growth of 11 percent in local currency in the past three years.

Highlights in 2022:

Roofboxes:

Strong growth.

Winter sports products boxes:

Strong growth.

Rooftop tents:

Continued strong growth in Europe.

RV Products

Awnings, bike racks and tents for RVs and caravans.

Share of Group sales in 2022:

18%

Market position:

Clear European market leader and niche player in the segment for smaller RVs in North America.

Long-term ambition:

To exceed the market trend.

Performance in 2022:

Growth of 17 percent exceeded that of the European RV and camper market, which according to our assessment decreased around 10 percent when it came to new manufacturing.

Annual average growth of 19 percent in local currency in the past three years in a market that we estimate has shrunk by an average of 3 percent per year in terms of new production.

Highlights in 2022:

Ability to manage the majority of quickly growing demand despite a very challenging global production chain.

Substantial growth in our niche premium products small RVs in a generally positive market in the US.

Juvenile & Pet Products

Bike trailers, child bike seats and strollers.

In connection with our Capital Market Day in May 2022, we presented the news that we will expand the product portfolio with child car seats and and products for dog transportation.

Read more about these products >>>

Share of Group sales in 2022:

11%

Market position:

Global market leader in bike trailers and one of the leading global players in child bike seats. Relatively new and fast-growing brand in strollers.

Long-term ambition:

Rapid growth driven by an expanded range, with the aim of expanding our market-leading position in bike-related products and becoming a major player also in premium strollers, and in the coming years, also in car seats and dog transport products.

Performance in 2022:

Sales declined 17 percent in local currency after an exceptionally strong 2021. Annual average growth of 16 percent in local currency in the past three years.

Highlights in 2022:

Bike trailers and child bike seats:

Retained market shares in the premium segment in a challenging market.

Strollers:

Stable growth in Europe.

Child carrier backpack:

Strong growth in this niche category with the awardwinning Thule Sapling.

Packs, Bags & Luggage

Luggage, backpacks and laptop bags for everyday use, hiking backpacks, camera bags, and cases for consumer electronics.

Share of Group sales in 2022:

9%

Market position:

Smaller player with niche offering.

Long-term ambition:

Stable growth through expanded offering of computer backpacks and sports bags, as well as through the further establishment of the Thule brand within cabin bags and duffel bags. Profitable anagement of phaseout of Legacy categories.

Performance in 2022:

Growth of 21 percent in local currency. Average annual growth of 2 percent in local currency in the past three years, with continuing phaseout of Legacy categories.

Highlights in 2022

• Smaller bags for everyday use:

Increased sales of computer backpacks and successful launched of crossbody bags in a number of collections.

• Cabin and duffel bags:

Successful launch of the Thule Aion collection, which is manufactured from 100-percent recycled material.

• Sports bags:

Increased sales of hydration backpacks and bike bags.